Capitec Bank Deposit Fees

Capitec Fixed Deposit Withdrawal

Find SAs best fixed deposit rates 🚀. FedGroup's misleading 11.3% 'Effective' Rate 😡😡😡 FedGroup has got some of the best rates in the country.

No one likes paying bank fees, so we do what we can to keep ours as low as possible. And we don’t do hidden costs. Ever! The fees below are effective as of 1 April 2018.

- Capitec Bank 1 Year Fixed Term Deposit: 7.92%: FNB 1 Month Fixed Deposit: 5.95%: Nedbank 1 Year Fixed Deposit: 7.44%: Investec 1 Month Fixed Deposit: 6.65%: Ask a.

- Capitec investment. In line with South Africa Revenue Service rules, Capitec has provided a tax-free savings account with the following benefits: You are permitted to open one tax free saving account at any of Capitec branches. You can deposit any amount up to R33 000 per year (single or multiple deposits).

- The nominal interest rate is used to calculate the daily interest earned on your account balance, which accumulates until it is capitalised on an agreed date every month. The interest is then either reinvested or transferred to your savings account.

- View the latest daily interest rates of all cash investment accounts, including fixed term deposits, notice deposits and instant access deposit accounts so that you can make an informed decision on where to deposit your hard earned cash and save for what matters most.

Deposits

Salary cheque FREE

Non-salary cheque 40.35

Cash for loan repayment FREE

Notes (cash-accepting ATM) 96c per R100

Notes/Coins (branch2) R2.27 per R100

Special clearance cheque 100.88

Returned cheque deposi t131.14

Incoming international payment in rand (fixed fee)5 100.88

Incoming international payment in foreign currency5 100.88

In South Africa, where household savings remain a national priority, there is a dire need to instil a savings culture. While there are various savings vehicles you could investigate, opening a savings account is undoubtedly one of the simplest.

Capitec Fixed Deposit Rates South Africa

But which savings account offers you the best deal? And should you opt for an open or fixed savings option?

Capitec Fixed Deposit Savings

Tip: To save more consider opening a tax-free savings account, here is all you need to know.

Justmoney compared the basic current savings account offerings from the big five banks, i.e. Absa, First National Bank (FNB), Standard bank, Capitec, and Nedbank.

Here is a breakdown:

Open savings accounts

Account name | Minimum deposit | Interest rate | |

Absa | TruSave | R50 | 3.70% |

FNB | Savings account | R100 | 5.25% - 6.30% |

Capitec | Global One | R25 | 5.1 % - 9.25 % |

Standard | Pure Save | R50 | 2.85% |

Nedbank | Savings deposit | R50 | 0.76% - 2.05% |

Based on the comparison table above, the Capitec Global One account boasts with the best interest earning potential as the highest in their interest rate range is capped at 9.25%. his stands head and shoulders above the rest in the market as FNB’s range cap follows at 6.30% and Absa at 3.70%. Nedbank came in at the other end of the stick as its interest rates proved lowest at 0.76%.

In addition to Capitec offering the best interest rates, it also has the lowest minimum deposit fee at R25. This again is a stand-out as Standard Bank, Nedbank, and Absa came in with double the fee at R50. FNB on the other hand ranks the most expensive of the lot at a R100 minimum deposit.

From the above we can conclude that Capitec Global One account is the cheapest account with the best interest offering.

Fixed savings accounts

Account name | Minimum deposit | Interest rate | Fixed period | |

Absa | Fixed deposit | R1000 | 3.25% - 9 % | 8 days – 6 months |

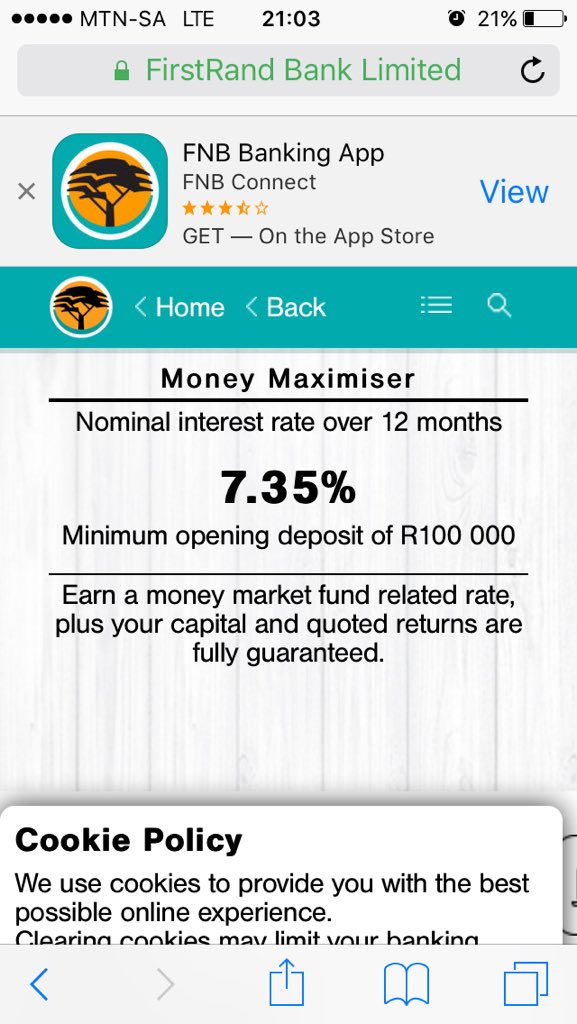

FNB | Fixed deposit | R10 000 | 8.70% | 1 – 60 months |

Capitec | Fixed deposit | R10 000 | 9.25% | 6 – 60 months |

Standard | Fixed deposit | R1000 | 9% | 1 – 18 months |

Nedbank | Fixed deposit | R1000 | 5.5% - 8.16% | 1 month – 18 months |

Based on the fixed account comparison, Capitec once again offers the best interest-earning potential at 9.25%. This is closely followed by the upper end of the interest ranges of Absa at 9%, Nedbank at 8.16%, and FNB at 8.70%. What’s important to note is that the interest depends on the period you are fixing your money for. Certain accounts such as the Standard Bank fixed deposit account offer between 1 – 18 months whereas others such as Absa and Capitec offer fixed options for up to 60 months.

The minimum deposit amounts range from the cheaper minimum deposit amounts of R1000 at Absa, Standard Bank, and Nedbank. Whereas Capitec and FNB offer fixed deposit accounts at a minimum deposit of R10,000.

What’s key to note is that the Capitec Global One account does have the added benefit of a fixed savings pocket, which does not require a minimum deposit of R10 000, but instead allows you to tailor the amount to your need.

Capitec Fixed Deposit Calculator

Based on the above, Capitec offers the best interest rates at 9.25% but requires one of the highest minimum deposits. Absa, Standard Bank, and Nedbank in turn offer the lowest minimum deposits, but also have the lowest interest-earning potential.

When considering the minimum deposit fees across the open and fixed savings account options we can conclude that fixed-term savings accounts offer the better interest rates. This, besides Capitec which offers the same interest rate of 9.25% with each account option.

The perks of a good savings account

“It is easier to withdraw money from savings accounts than from stock, bonds, and certificates of deposits, which results in penalties,” says Cowyk Fox, managing executive of Everyday Banking, RBB SA, Absa Group.

Savings accounts will usually accrue interest over time. This means your money has more earning potential than if you would have kept it in a safe at home.

Himal Parbhoo, CEO of FNB Retail Cash Investments offers the following tips:

- A savings account helps when the unexpected strikes. In case of an emergency, the rule of thumb is to have at least 3 months’ worth of salary saved in a separate savings account, in case of unexpected expenses.

- Savings accounts also help you save towards specific goals like holidays, car or home deposits, weddings, big birthdays or anniversaries.

- Fixed-term savings are great for keeping savings safe and growing – it can also supplement income as the interest can be paid out monthly.

What do you need to open a savings account?

If you don’t already have a savings account and are looking to open one, here are few general requirements:

- Applicants must be 18 years of age and be earning

- Applicants must be able to produce a South African identification document (ID) or their passport, as well as a copy of their proof of address.

- You must also be able to produce the minimum opening deposit. This may vary from bank to bank and further between accounts.

It is always advisable to do your research before opening any account at any financial institution in deciding which is the best option for you and your pocket.